Regulations

autorités internationales

MARCHÉS FINANCIERS

Not Applicable

lutte contre le blanchiment des capitaux et le financement du terrorisme (LCB-FT)

Convention de Palerme (2000) et Convention de Mérida (2003) fixent des standards mondiaux contre le crime organisé et la corruption.

SANCTIONS internationales

Résolutions du Conseil de sécurité de l’ONU imposent sanctions (ex. Corée du Nord, Iran, terrorisme), transposées par les États membres.

etats-unis

MARCHÉS FINANCIERS

Securities Act (1933) et Exchange Act (1934) encadrent marchés et émissions de titres ;

Dodd-Frank Act (2010)renforce transparence et supervision.

lutte contre le blanchiment des capitaux et le financement du terrorisme (LCB-FT)

Bank Secrecy Act (1970)impose obligations de vigilance et reporting (SAR, CTR) ;

USA PATRIOT Act (2001)renforce le dispositif AML/CFT.

SANCTIONS internationales

OFAC Sanctions Programs (Trésor) appliquent sanctions économiques et financières décidées par le gouvernement.

union européenne

MARCHÉS FINANCIERS

MiFID II harmonise la transparence et la protection des investisseurs ;

MAR encadre les abus de marché ;

CRR/CRD IV-V fixent les exigences prudentielles.

AIFMD & UCITS : réglementation des fonds d’investissement alternatifs et OPCVM

lutte contre le blanchiment des capitaux et le financement du terrorisme (LCB-FT)

4e à 6e directives AML (AMLD)imposent normes AML/CFT aux États membres ;

EBA guidelines renforcent la surveillance.

SANCTIONS internationales

Règlements européens sur les sanctionss’appliquent directement et obligent les États membres à les exécuter.

france

MARCHÉS FINANCIERS

Code monétaire et financier et Règlement général de l’AMF organisent la régulation des marchés.

lutte contre le blanchiment des capitaux et le financement du terrorisme (LCB-FT)

Code monétaire et financier impose vigilance AML/CFT, renforcé par les directives européennes;

TRACFIN centralise les déclarations (via ERMES).

SANCTIONS internationales

Textes européens (règlements de sanctions) transposés et appliqués par la Direction du Trésor.

luxembourg

MARCHÉS FINANCIERS

Loi du 5 avril 1993 encadre le secteur financier et la CSSF ; transposition des directives européennes.

lutte contre le blanchiment des capitaux et le financement du terrorisme (LCB-FT)

Loi du 12 novembre 2004 impose obligations AML/CFT et confie la supervision à la CRF.

SANCTIONS internationales

Règlements européens de sanctions appliqués directement par le Luxembourg.

royaume-uni

MARCHÉS FINANCIERS

Financial Services and Markets Act (FSMA, 2000) cadre juridique principal de la régulation financière. ;

Senior Managers and Certification Regime (SMCR) : responsabilité individuelle renforcée dans les institutions financières et dirigeants.

lutte contre le blanchiment des capitaux et le financement du terrorisme (LCB-FT)

Money Laundering Regulations (MLR)transposition directives européennes;

Sanctions and Anti-Money Laundering Act (SAMLA) : cadre AML/CFT post-Brexit.

SANCTIONS internationales

SAMLA (2018) confère à l’OFSI le pouvoir de mettre en œuvre des sanctions autonomes et celles de l’ONU.

suisse

MARCHÉS FINANCIERS

Loi sur la surveillance des marchés financiers (LFINMA) cadre de surveillance des marchés;

Loi sur les banques et LBVMencadrent banques et bourses.

lutte contre le blanchiment des capitaux et le financement du terrorisme (LCB-FT)

LBA (1997, AMLA) oblige institutions financières à déclarer toute transaction suspecte à la MROS.

SANCTIONS internationales

Ordonnances fédérales mettent en œuvre les sanctions de l’ONU et de l’UE, sous contrôle du SECO.

canada

MARCHÉS FINANCIERS

Bank Act régule banques ;

Securities Acts provinciaux régulent marchés financiers (ex. Ontario Securities Act).

lutte contre le blanchiment des capitaux et le financement du terrorisme (LCB-FT)

PCMLTFA (2000) oblige reporting AML/CFT via FINTRAC.

SANCTIONS internationales

SEMA et Justice for Victims of Corrupt Foreign Officials Act (Magnitsky Act)fixent le cadre national des sanctions.

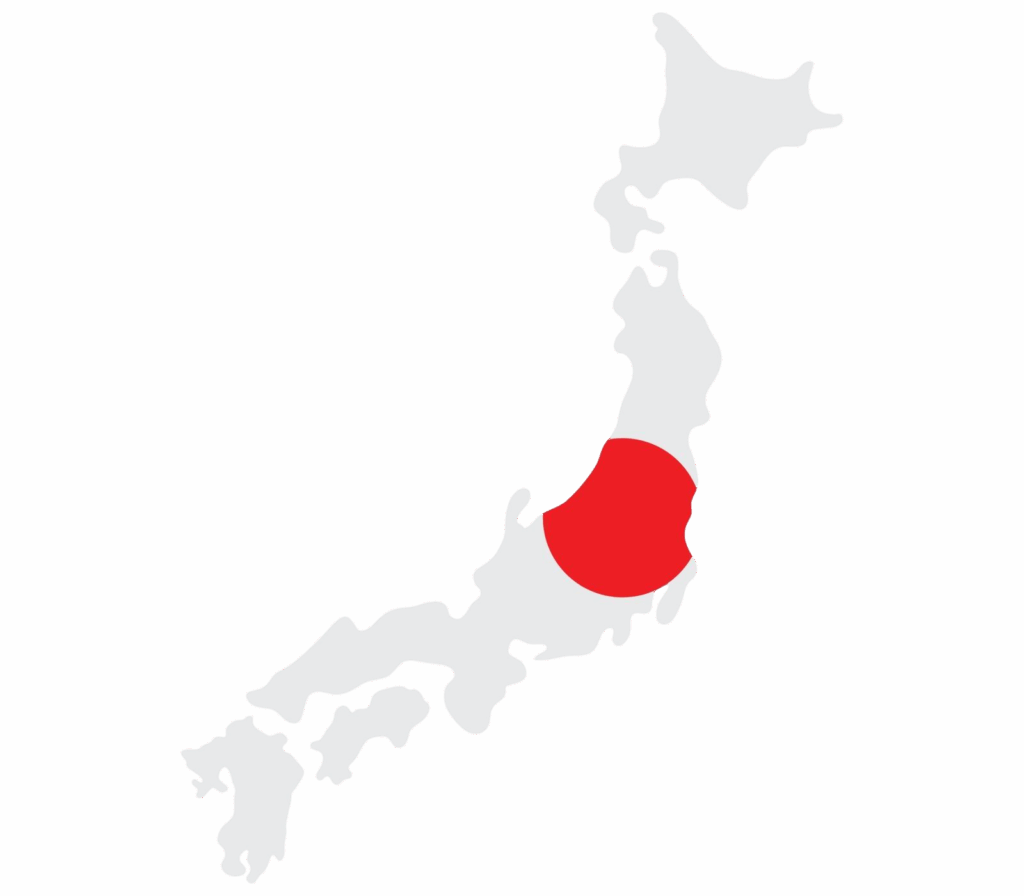

japon

MARCHÉS FINANCIERS

Financial Instruments and Exchange Act (FIEA) régule marchés financiers ;

Banking Act supervise banques.

lutte contre le blanchiment des capitaux et le financement du terrorisme (LCB-FT)

Act on Prevention of Transfer of Criminal Proceeds (2007) fixe le cadre AML/CFT, mis en œuvre par JAFIC.

SANCTIONS internationales

FEFTA (Foreign Exchange and Foreign Trade Act) fonde les sanctions économiques décidées par le Japon.

australie

MARCHÉS FINANCIERS

Corporations Act (2001) et ASIC Act (2001) régulent marchés et intermédiaires; APRA supervise stabilité bancaire.

lutte contre le blanchiment des capitaux et le financement du terrorisme (LCB-FT)

AML/CTF Act (2006) fixe obligations de déclaration et vigilance via AUSTRAC.

SANCTIONS internationales

Autonomous Sanctions Act (2011) et Charter of the United Nations Act permettent l’application des sanctions autonomes et onusiennes.

International authorities

Not Applicable

The Palermo Convention (2000) and the Merida Convention (2003) establish global standards against organized crime and corruption.

UN Security Council resolutions impose sanctions (e.g., North Korea, Iran, terrorism), which are transposed by Member States.

United-States

The Securities Act (1933) and the Exchange Act (1934) regulate markets and securities offerings;

The Dodd-Frank Act (2010) strengthens transparency and supervision.

The Bank Secrecy Act (1970) imposes due diligence and reporting obligations (SAR, CTR);

The USA PATRIOT Act (2001) strengthens the AML/CFT framework.

OFAC Sanctions Programs (Treasury) enforce economic and financial sanctions decided by the government.

European Union

MiFID II harmonizes transparency and investor protection;

MAR regulates market abuse;

CRR/CRD IV-V set prudential requirements;

AIFMD & UCITS: regulation of alternative investment funds and UCITS.

The 4th to 6th AML Directives (AMLD) impose AML/CFT standards on Member States;

EBA guidelines strengthen supervision

European sanctions regulations apply directly and require Member States to enforce them.

France

The Monetary and Financial Code and the AMF General Regulation govern market regulation.

The Monetary and Financial Code imposes AML/CFT due diligence, reinforced by European directives;

TRACFIN centralizes reports (via ERMES)

European texts (sanctions regulations) are transposed and enforced by the Treasury Directorate.

Luxembourg

The Law of April 5, 1993 regulates the financial sector and the CSSF; it transposes European directives.

The Law of November 12, 2004 imposes AML/CFT obligations and assigns supervision to the CRF.

European sanctions regulations are directly applied by Luxembourg.

United Kingdom

The Financial Services and Markets Act (FSMA, 2000) is the main legal framework for financial regulation.

The Senior Managers and Certification Regime (SMCR) strengthens individual accountability within financial institutions and their executives.

The Money Laundering Regulations (MLR) transpose European directives;

The Sanctions and Anti-Money Laundering Act (SAMLA) provides the post-Brexit AML/CFT framework.

SAMLA (2018) grants the OFSI the power to implement both autonomous sanctions and UN sanctions.

Switzerland

The Financial Market Supervision Act (LFINMA) provides the market supervision framework;

The Banking Act and LBVM regulate banks and stock exchanges.

LBA, 1997, AMLA requires financial institutions to report any suspicious transactions to the MROS.

Federal ordinances implement UN and EU sanctions under the supervision of the SECO.

Canada

The Bank Act regulates banks;

Provincial Securities Acts regulate financial markets (e.g., Ontario Securities Act)

The PCMLTFA (2000) requires AML/CFT reporting through FINTRAC.

SEMA and the Justice for Victims of Corrupt Foreign Officials Act (Magnitsky Act) establish the national sanctions framework

japan

The Financial Instruments and Exchange Act (FIEA) regulates financial markets;

The Banking Act supervises banks.

The Act on Prevention of Transfer of Criminal Proceeds (2007) establishes the AML/CFT framework, implemented by JAFIC.

The FEFTA (Foreign Exchange and Foreign Trade Act) establishes the economic sanctions implemented by Japan.

AUSTRALIa

The Corporations Act (2001) and ASIC Act (2001) regulate markets and intermediaries;

APRA supervises banking stability.

The AML/CTF Act (2006) sets reporting and due diligence obligations through AUSTRAC.

The Autonomous Sanctions Act (2011) and the Charter of the United Nations Act enable the implementation of both autonomous and UN sanctions.