Regulatory and Supervisory Authorities

International authorities

FINANCIAL MARKETS

OICV/IOSCO :International association of securities and derivatives regulators. Develops and promotes standards to protect investors and reduce systemic risks.

ANTI-MONEY LAUNDERING AND COUNTER-TERRORISM FINANCING (AML/CTF)

GAFI/FATF : Intergovernmental body. Its recommendations are not legally binding but serve as global standards for AML/CFT.

INTERNATIONAL SANCTIONS

ONU : The UN Security Council (UNSC) establishes sanctions regimes through binding resolutions for member states.

UNITED STATES

FINANCIAL MARKETS

SEC supervises securities markets and protects investors

CFTC regulates derivatives

FINRA oversees brokers.

ANTI-MONEY LAUNDERING AND COUNTER-TERRORISM FINANCING (AML/CTF)

FinCEN collects and analyzes suspicious activity reports (SARs) and issues AML/CFT regulations.

INTERNATIONAL SANCTIONS

OFAC enforces economic and sanctions decided by the U.S. government.

EUROPEAN UNION

FINANCIAL MARKETS

ANTI-MONEY LAUNDERING AND COUNTER-TERRORISM FINANCING (AML/CTF)

AMLA Anti-Money Laundering Authority, created in 2024): dedicated EU body for AML/CFT, with direct supervisory powers over high-risk entities and authority to impose administrative sanctions. Coordinates FIUs, centralizes data, harmonizes standards and methodologies.

EBA also develops AML guidelines for banks.

INTERNATIONAL SANCTIONS

Commission européenne designs and implements EU sanctions regimes

france

FINANCIAL MARKETS

AMF regulates securities markets, listed companies, and intermediaries

ANTI-MONEY LAUNDERING AND COUNTER-TERRORISM FINANCING (AML/CTF)

TRACFIN is the financial intelligence unit of the French Ministry of Economy and Finance. As both a financial intelligence unit and a first-circle intelligence service, it contributes to the development of a healthy economy by fighting against clandestine financial circuits, money laundering, and the financing of terrorism.

ACPR is responsible for supervising the quality of the AML/CFT framework of the institutions it oversees.

The DG Trésor leads AML/CFT policy and proposes improvements to the national framework through the COLB. It therefore takes part in drafting French regulations on anti-money laundering.

INTERNATIONAL SANCTIONS

Ministry of Economy/ Treasury Department enforces sanctions adopted by France and the EU

luxembourg

FINANCIAL MARKETS

CSSF supervises banks, funds, and securities markets

ANTI-MONEY LAUNDERING AND COUNTER-TERRORISM FINANCING (AML/CTF)

FIU Cellule de Renseignement Financier processes AML/CFT suspicions

The CSSF is in charge of ensuring compliance with the professional obligations regarding the fight against money laundering and terrorist financing by all the persons supervised, authorised or registered by it.

INTERNATIONAL SANCTIONS

Ministry of Finance / Financial Sanctions Service enforces EU and national sanctions.

UNITED KINGDOM

FINANCIAL MARKETS

FCA supervises conduct of financial firms and security markets

PRA ensures the soundness of banks and insurers.

ANTI-MONEY LAUNDERING AND COUNTER-TERRORISM FINANCING (AML/CTF)

NCA/UKFIU receives, analyzes AML/CFT suspicious reports

INTERNATIONAL SANCTIONS

OFSI implements sanctions decided by the UK government.

SWITZERLAND

FINANCIAL MARKETS

FINMA supervises banks, insurers, and securities markets

ANTI-MONEY LAUNDERING AND COUNTER-TERRORISM FINANCING (AML/CTF)

MROS (Money Laundering Reporting Office Switzerland) receives and analyzes AML/CFT suspicious reports

INTERNATIONAL SANCTIONS

SECO enforces sanctions adopted by the Swiss Confederation.

canada

FINANCIAL MARKETS

OSFI supervises banks, insurers, and pension funds

L’AMF regulates securities markets, insurance, derivatives, and distribution.

ANTI-MONEY LAUNDERING AND COUNTER-TERRORISM FINANCING (AML/CTF)

FINTRAC collects and analyzes AML/CFT purposes

INTERNATIONAL SANCTIONS

GAC (Global Affairs Canada) administers sanctions regimes.

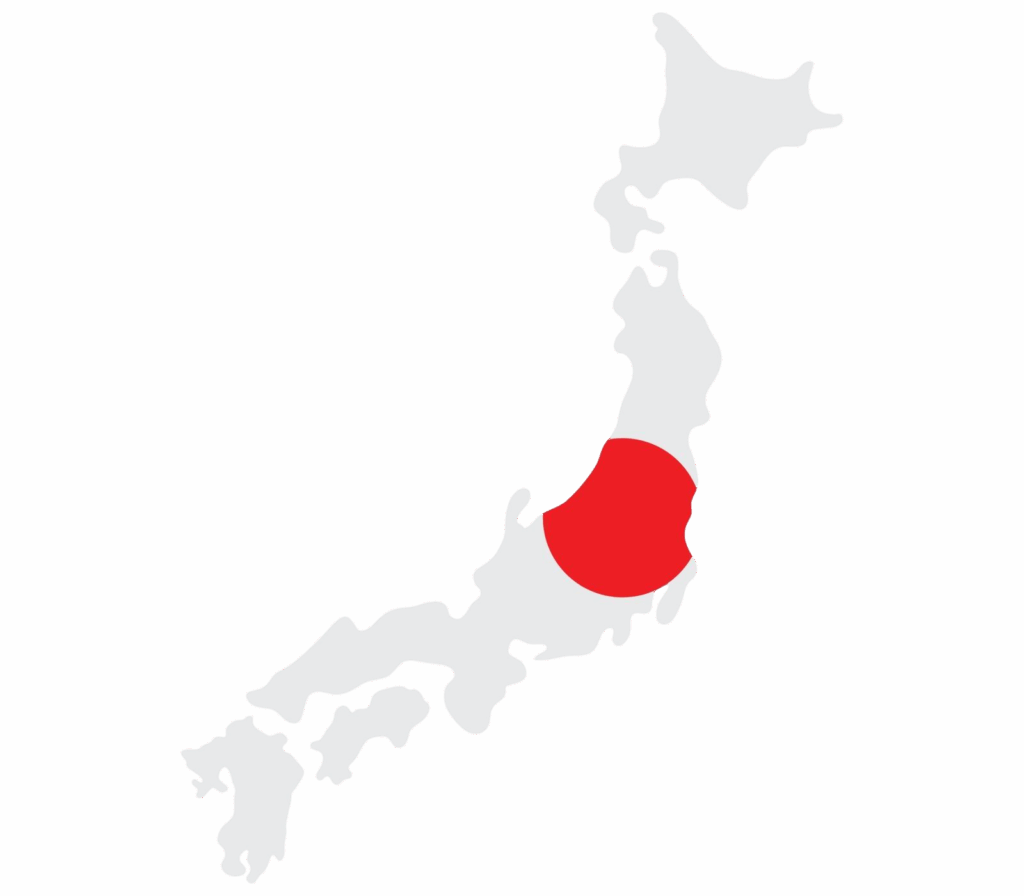

japan

FINANCIAL MARKETS

FSA regulates financial markets, banks, and insurers.

ANTI-MONEY LAUNDERING AND COUNTER-TERRORISM FINANCING (AML/CTF)

JAFIC (Japan Financial Intelligence Center) handles AML/CFT suspicious reports.

INTERNATIONAL SANCTIONS

MOFA (Ministry of Foreign Affairs) enforces Japan’s sanctions regimes.

australia

FINANCIAL MARKETS

ASIC supervises securities markets, listed companies, and intermediaries.

APRA is Australia’s prudential supervisor, responsible for ensuring that our financial system is stable, competitive and efficient.

ANTI-MONEY LAUNDERING AND COUNTER-TERRORISM FINANCING (AML/CTF)

AUSTRAC performs a dual role as Australia’s anti-money laundering and counter-terrorism financing (AML/CTF) regulator and financial intelligence unit. This dual role helps to build resilience in the financial system and enables AUSTRAC to use financial intelligence and regulation to disrupt money laundering, terrorism financing and other serious crime.

INTERNATIONAL SANCTIONS

DFAT /ASO is the Australian Government’s sanctions regulator. The ASO provides guidance to regulated entities on sanctions, processes applications for sanctions permits, and collaborates with other agencies to monitor and enforce compliance with Australian sanctions laws.

International authorities

OICV/IOSCO: International association of securities and derivatives regulators. Develops and promotes standards to protect investors and reduce systemic risks.

GAFI/FATF : Intergovernmental body. Its recommendations are not legally binding but serve as global standards for AML/CFT.

ONU : The UN Security Council (UNSC) establishes sanctions regimes through binding resolutions for member states.

United States

FinCEN collects and analyzes suspicious activity reports (SARs) and issues AML/CFT regulations.

OFAC enforces economic and sanctions decided by the U.S. government.

European Union

AMLA Anti-Money Laundering Authority, created in 2024): dedicated EU body for AML/CFT, with direct supervisory powers over high-risk entities and authority to impose administrative sanctions. Coordinates FIUs, centralizes data, harmonizes standards and methodologies.

EBA also develops AML guidelines for banks.

Commission européenne designs and implements EU sanctions regimes.

France

AMF regulates securities markets, listed companies, and intermediaries.

TRACFIN is the financial intelligence unit of the French Ministry of Economy and Finance. As both a financial intelligence unit and a first-circle intelligence service, it contributes to the development of a healthy economy by fighting against clandestine financial circuits, money laundering, and the financing of terrorism.

ACPR is responsible for supervising the quality of the AML/CFT framework of the institutions it oversees.

The DG Trésor leads AML/CFT policy and proposes improvements to the national framework through the COLB. It therefore takes part in drafting French regulations on anti-money laundering.

Ministry of Economy / Treasury Department enforces sanctions adopted by France and the EU

Luxembourg

CSSF supervises banks, funds, and securities markets

FIU Cellule de Renseignement Financier processes AML/CFT suspicions

The CSSF is in charge of ensuring compliance with the professional obligations regarding the fight against money laundering and terrorist financing by all the persons supervised, authorised or registered by it.

Ministry of Finance / Financial Sanctions Service enforces EU and national sanctions.

United Kingdom

NCA/UKFIU receives, analyzes AML/CFT suspicious reports.

OFSI implements sanctions decided by the UK government.

Switzerland

FINMA supervises banks, insurers, and securities markets.

MROS (Money Laundering Reporting Office Switzerland) receives and analyzes AML/CFT suspicious reports.

SECO enforces sanctions adopted by the Swiss Confederation.

Canada

FINTRAC collects and analyzes AML/CFT purposes.

GAC (Global Affairs Canada) administers sanctions regimes.

japan

FSA regulates financial markets, banks, and insurers.

JAFIC (Japan Financial Intelligence Center) handles AML/CFT suspicious reports.

MOFA (Ministry of Foreign Affairs) enforces Japan’s sanctions regimes.

AUSTRALIa

AUSTRAC performs a dual role as Australia’s anti-money laundering and counter-terrorism financing (AML/CTF) regulator and financial intelligence unit. This dual role helps to build resilience in the financial system and enables AUSTRAC to use financial intelligence and regulation to disrupt money laundering, terrorism financing and other serious crime.

DFAT /ASO is the Australian Government’s sanctions regulator. The ASO provides guidance to regulated entities on sanctions, processes applications for sanctions permits, and collaborates with other agencies to monitor and enforce compliance with Australian sanctions laws.